State legislators urge Elizabeth Warren, Democrat leaders to pass crypto regulatory framework

A letter from state Democrats calls for bipartisan action to pass federal cryptocurrency laws

Welcome to the Friday edition of the Crypto In America newsletter!

We’re wrapping up a busy news week with an exclusive look at a call to action from pro-crypto state legislators to senior Democrats in Congress, urging them to help Republicans pass a federal regulatory framework for digital assets.

On Friday morning, Maryland Delegate Adrian Boafo and New York Assemblyman Clyde Vanel sent a joint letter to Democratic Congressional leaders urging the creation of a federal framework to bolster state-level cryptocurrency regulations.

The letter, addressed to Senators Elizabeth Warren (D-MA) and Amy Klobuchar (D-MN), as well as Representatives Maxine Waters (D-CA) and Angie Craig (D-MN), highlights the rapid advancement of state crypto policy strengthening the need for federal guidelines to prevent a “fragmented” regulatory landscape.

“Already, at least 35 states…have introduced cryptocurrency-related legislation, ranging from legal recognition of digital assets to outright restrictions,” the letter stated. “Without federal action, this fragmented approach will only grow, creating uncertainty for businesses and limiting financial opportunities for millions of Americans.”

The letter, first reported by Crypto In America, comes as Republican leaders are working feverishly to pass legislation around payment stablecoins and a market structure bill at the request of President Trump, who said Thursday that the U.S. would “dominate crypto and the next generation of financial technologies.”

While more Democrats have been voting in favor of pro-crypto policies this Congress, Boafo and Vanel are concerned the agendas of entrenched crypto-skeptics, like Elizabeth Warren and Maxine Waters, could hamstring bipartisan efforts to get a regulatory framework across the finish line.

“The Democrats have long led the way in advancing progressive technology policies and fostering bipartisan collaboration,” the pair said in a joint statement. “We must continue that legacy by working across the aisle to establish clear, unified regulations for the digital market.”

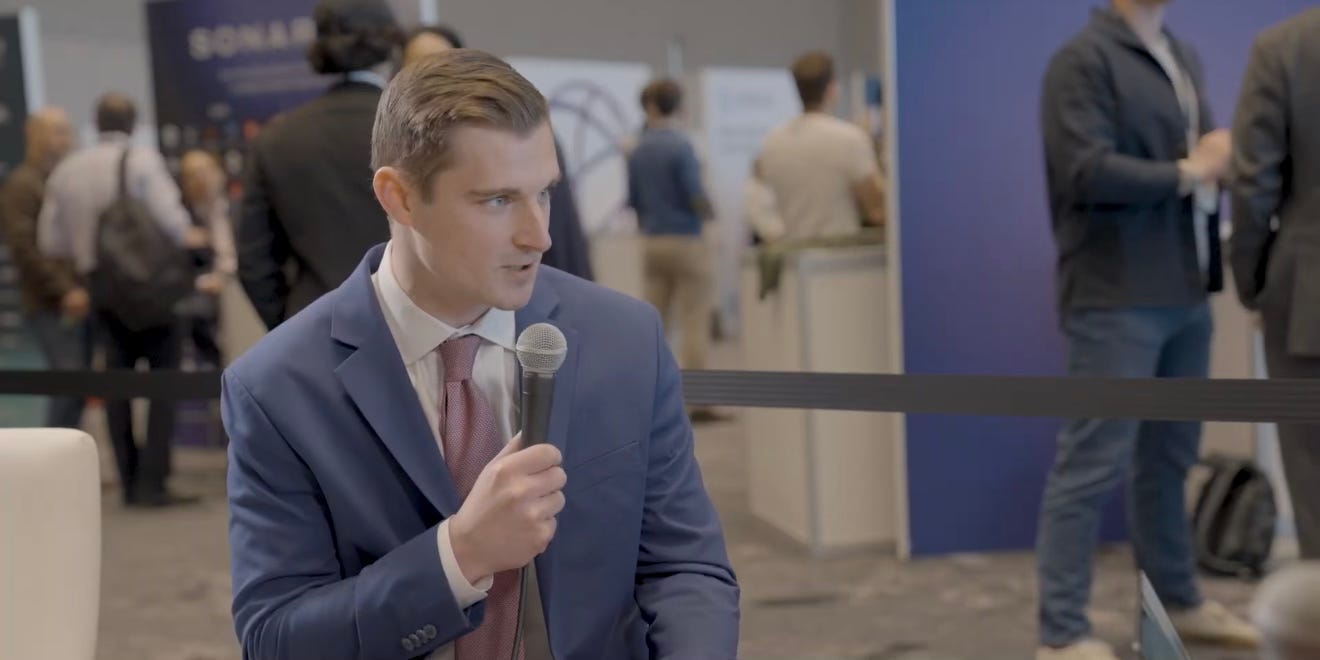

There’s been “countless ideas” to find budget neutral ways to buy Bitcoin, says Hines

President Trump’s crypto working group executive director Bo Hines told Crypto In America the White House has been throwing around ideas for how the government could begin to accumulate the world’s largest digital currency without costing the American taxpayers a dime.

“There’s been countless ideas over the course of the last week or so in the sense of how we can actually accomplish this,” Hines said, mentioning a proposal from Republican Wyoming Senator Cynthia Lummis to convert the gains on gold certificates held by the US Treasury into Bitcoin. “If we realize the gains on that, that would be a budget neutral way to acquire Bitcoin.”

The crypto industry has been trying to guess how exactly the government could start acquiring Bitcoin after President Trump signed an executive order earlier this month directing his Treasury and Commerce secretaries to develop budget-neutral strategies for adding to the roughly 200,000 Bitcoins it already holds.

“As we convene as a working group we’ll flesh out the best ideas and we’ll enact those ideas,” he said.

Catch the full bonus episode with Hines, recorded at Blockworks Digital Asset Summit, on Spotify, Apple and YouTube.

SEC to hold ‘crypto clarity’ roundtable today

The Securities and Exchange Commission kicks off “The Spring Sprint Toward Crypto Clarity” industry roundtable series this afternoon to address the complex topic of defining security status for digital assets.

A panel of eleven legal fintech gurus will discuss how cryptocurrencies may or may not fit into existing securities laws and look for ways to establish clarity around a complex issue that’s loomed over the industry for years.

The event begins at 1:00PM EST and will be live-streamed via the SEC website.

You can watch it here.

Weekly Recap

Here are some of the biggest news stories this week from the intersection of Washington and Web3:

The SEC’s Division of Corporation Finance released guidance on how certain proof-of-work mining protocols should be viewed under existing securities laws. More specifically, the department says it believes that “solo” and “pool” mining, two methods used to “mine” Bitcoin, do not trigger the Howey Test (the agency’s litmus test for defining security status) because miners are not relying on the efforts of others to earn a profit, rather they are earning rewards stemming from their own contributions to securing the network.

The SEC agreed to drop its appeal in the four-year long legal battle with blockchain payments firm Ripple, pending approval by the commission. Ripple may choose to appeal a district court ruling ordering it to pay $125 million for selling unregistered XRP tokens to institutional investors.

Crypto derivatives exchange Bitnomial launched the first ever CFTC-regulated XRP futures contract in the wake of the SEC withdrawing its appeal against Ripple, a case that would have challenged the security status of XRP. Bitnomial also voluntarily dismissed its own lawsuit challenging the SEC’s prior assertion that Bitnomial's XRP futures are a security futures contract.

President Trump became the first sitting U.S. president to address a cryptocurrency conference when he gave a remote speech at the Blockworks Digital Asset Summit on Thursday. In a three-minute video, Trump highlighted his crypto achievements since taking office, including instructing Congress to pass crypto legislation, establishing a strategic Bitcoin reserve, and rolling back efforts by banking regulators to restrict financial services to crypto firms and customers.

Remember, new editions of the Crypto In America newsletter drop every Monday, Wednesday and Friday at 7AM EST.

If you like what you’re reading, don’t forget to subscribe!