DOJ Signals Continued Focus on Roman Storm Despite Crypto Scrutiny Shift

New DOJ guidelines leave Tornado Cash case on the table

Welcome to the Wednesday edition of the Crypto In America newsletter!

An important footnote in the Department of Justice's recent memo, outlining its intention to reduce scrutiny on crypto platforms, suggests that the Department may not be ready to abandon its high-profile case against Roman Storm, co-founder of the crypto mixer Tornado Cash.

In the memo, the Deputy Attorney General clarifies that the DOJ will not pursue charges against crypto platforms under Section 1960 for operating as unlicensed money transmitters unless there is evidence the platform knowingly violated licensing requirements. The DOJ will also refrain from prosecuting cases where the only allegations are related to securities and commodities laws, acknowledging that it is not a regulator of digital assets.

However, as outlined in the footnote, the new policy does not apply to Section 1960(b)(1)(C), which addresses money laundering. This means that if someone knowingly transmits funds derived from criminal activities (such as money laundering), or if the funds are intended to support illegal activities, it remains a criminal offense under Section 1960(b)(1)(C).

Roman Storm is facing charges for knowingly facilitating money laundering through Tornado Cash, a non-custodial platform, meaning neither the software nor the software developer ever takes possession of a user’s funds. The DOJ’s decision to carve out this section of 1960 is significant because it suggests that the Department may still try to pursue these charges, despite Storm never directly controlling user funds himself.

It’s unclear whether the DOJ, under Attorney General Pam Bondi, will abandon its case against Storm, whose trial is scheduled to begin in July. A DOJ spokesperson did not immediately respond to a request for comment.

On the Hill Today

We’ll have our eye on a few noteworthy events taking place in Congress today:

The Senate has scheduled a procedural cloture vote for SEC Chair nominee Paul Atkins at 11:30 AM EST. If that vote succeeds, he could have a full confirmation vote as early as 7:00 PM this evening.

The House Financial Services Committee’s Subcommittee on Digital Assets will hold a hearing titled “American Innovation and the Future of Digital Assets Aligning the U.S. Securities Laws for the Digital Age” at 10:00 AM EST. You can watch here.

The House Agriculture Committee will hold a hearing at 2:00 PM EST called “American Innovation and the Future of Digital Assets: On-Chain Tools for an Off-Chain World.” You can watch here.

Midweek Recap

Here are some of the biggest stories so far this week:

As part of the memo outlining its renewed approach to policing digital assets, the DOJ also disbanded its National Cryptocurrency Enforcement Team. Deputy Attorney General Todd Blanche stated that individual U.S. attorney’s offices will now be responsible for overseeing crypto enforcement cases, which will primarily focus on crimes involving terrorism.

Blockchain payments firm Ripple has acquired prime brokerage Hidden Road for $1.25 billion, positioning itself as a major player in traditional finance. The deal will enhance institutional access to digital assets while making Hidden Road’s operations more efficient by using the XRP Ledger for faster and cheaper trade clearing and settlement.

BlackRock has enlisted federally chartered crypto bank Anchorage Digital as a second custodian, alongside Coinbase, for its spot Bitcoin and Ethereum exchange-traded products (ETPs). BlackRock is currently the largest issuer of spot crypto ETPs in the world, with $50B in AUM, as of April 3, 2025.

Crypto investment firm Galaxy Digital is planning to list on the NASDAQ in the coming weeks after the Securities and Exchange Commission green lighted its registration statement. Galaxy, founded by Mike Novogratz, is undergoing a reorganization that will see its operations move from the Cayman Islands to Delaware — signaling the firm is looking to take advantage of the U.S.’s new crypto-friendly corporate environment.

Crypto attorney James Murphy has filed a lawsuit against the Department of Homeland Security, seeking to uncover the true identity of Satoshi Nakamoto, the elusive creator of Bitcoin. Murphy believes the DHS holds information about Nakamoto's identity and is suing to compel the department to comply with his Freedom of Information Act (FOIA) requests on the matter.

Read the full story, a Crypto In America exclusive, here.

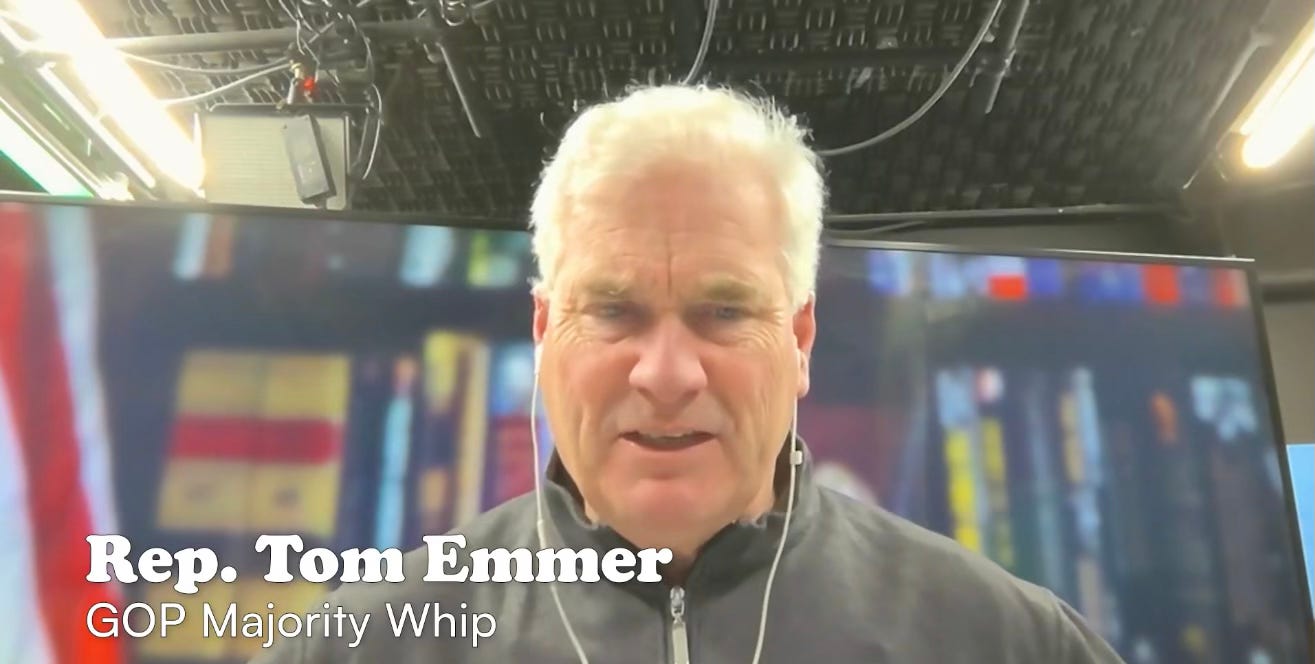

Crypto In America Episode 5: House Majority Whip Tom Emmer (R-MN)

Catch the full fifth episode of Crypto In America with House Majority Whip Tom Emmer as we discuss making crypto non-partisan, the importance of legislation, his hopes for the SEC under incoming Chairman Paul Atkins, the 2026 midterms, and more.

Remember, new editions of the Crypto In America newsletter drop every Monday, Wednesday and Friday at 7AM EST.

If you like what you’re reading, don’t forget to subscribe!

The links to the Senate & House hearings are golden.